kansas sales tax exemption form pdf

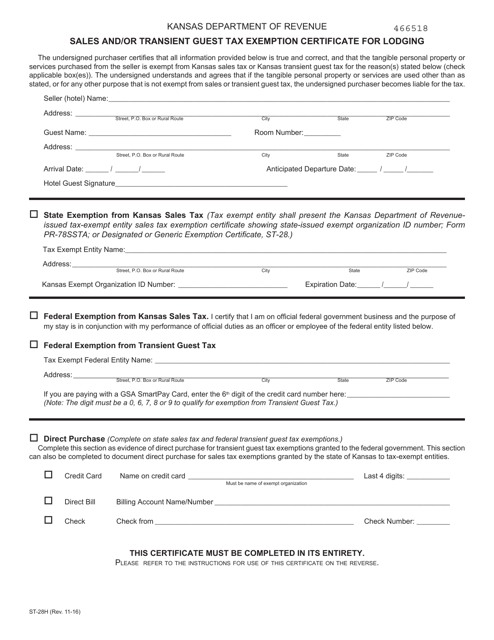

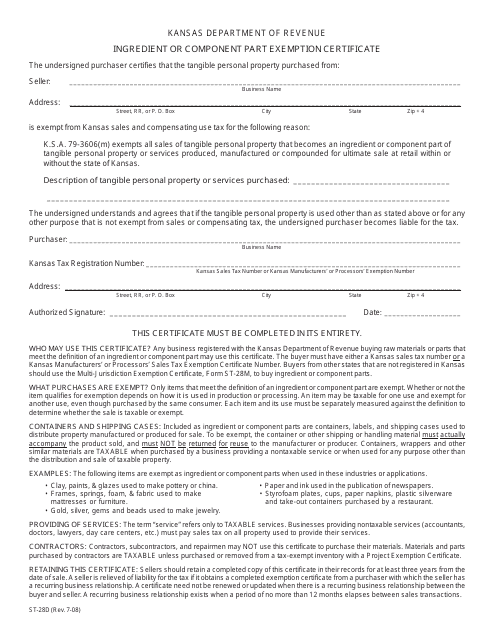

The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not exempt. If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Kansas sales tax you need the appropriate Kansas sales tax exemption certificate before you can begin making tax-free purchases.

Minnesota Bill Of Sale Form For Ibm Storage Equipment Download The Free Printable Basic Bill Of Sale Blank Form Minnesota Bill Of Sale Template Hennepin County

Printable Kansas Exemption Certificates.

. T00112020 The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not. Department of Revenue has been assigned a number. Address of meter location.

The 004 is the number assigned to Retailers Sales Tax. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide.

Ov for additional information. Click Continue and review to ensure you have the correct certificate then click Save. 79-201 Ninth Humanitarian service provider TX Addition 79-201 Ninth pdf KSA.

Ad KS Affidavit of Exempt Status More Fillable Forms Register and Subscribe Now. Use Fill to complete blank online KANSAS DEPARTMENT OF COMMERCE KS pdf forms for free. Ad Register and Edit Fill Sign Now your KS ST-28A Form more fillable forms.

Each tax type administered by the Kansas. Street RR or P. The tax-exempt entity understands and agrees that if the tangible personal property andor service are used other than as stated or for any purpose that is not.

Complete a form for each meter on which you are applying for an exemption. Order for the sale to be exempt. Please type or print this form and send a completed copy WITH worksheets to your utility company.

The seller may require a copy of the buyers Kansas sales tax registration certificate as a condition for honoring this certificate. Kansas Sales Tax Exemption Resale Forms 4 PDFs. Sellers should retain a.

Street RR or P. The following entities and organizations are exempt and issued a Tax Exempt Entity Certificate from the Kansas Department of Revenue. Sales and Use Tax Entity Exemption Certificate.

This page explains how to make tax-free purchases in Kansas and lists four. Current Format of Sales Tax Account Numbers A Kansas Sales tax account number is a fifteen-character number. Once the KsWebTax is created you will be taken to the Exemption Certificate page.

Box City State Zip 4. Is exempt from Kansas sales and compensating use tax for the following reason. In accordance with the Kansas Retailers Sales Tax Act the undersigned purchaser states that the circle one.

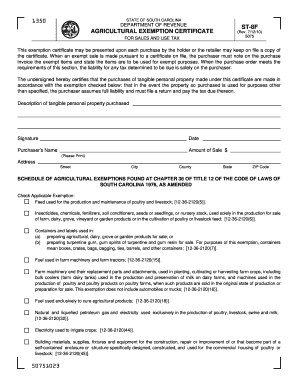

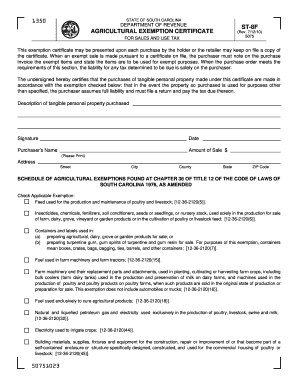

Your Kansas sales tax account number has three distinct parts. KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or service purchased from. The certificate is to be presented by tax exempt entities to retailers to purchase goods andor services tax exempt from sales and use tax.

Form used to apply for a sales and use tax refund Keywords. Is exempt from Kansas sales and compensating use tax for the following reason. We have four Kansas sales tax exemption forms available for you to print or save as a PDF file.

Ad New State Sales Tax Registration. Your Kansas sales tax account number has three distinct parts. Box City State Zip 4 _____ is exempt from Kansas sales and compensating use tax for the following reason.

Kansas Department of Revenue. There are three parts to your Kansas Sales Tax Account Number. Department of Revenue has been assigned a number.

Once completed you can sign your fillable form or send for signing. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. Tax Type EIN A or K number End code 004 4812345678F 01 004 K12345678F 01 004 A12345678F 01.

KANSAS DEPARTMENT OF REVENUE AGRICULTURAL EXEMPTION CERTIFICATE The undersigned purchaser certifies that the tangible personal property or services purchased from. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below. KANSAS SALES AND USE TAX REFUND APPLICATION.

Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. 10012024 The tax-exempt entity understands and agrees that if the tangible personal. The Kansas Department of Revenue certifies this entity is exempt from paying Kansas sales andor compensating use tax as stated below.

The 004 is the number assigned to Retailers Sales Tax. Reason for Exemption For requests under KSA. 79-3606n you must include a factual statement of usage along with exemption reason.

This sales tax exemption is in the Kansas Department of Revenues Notice 00-08 Kansas Exemption for Manufacturing Machinery Equipment as Expanded by KSA. To apply for update and print a sales and use tax exemption certificate. Each tax type administered by the Kansas.

Sales Tax Account Number Format. Wholesalers and buyers from other states not registered in Kansas should use the Multi-Jurisdiction Exemption Certificate Form ST-28M to purchase their inventory. HOWEVER if the inventory item purchased by an out-of-state retailer who has sales tax nexus with Kansas is drop shipped to a Kansas location the out-of-state retailer must provide.

Sales Tax Account Number Format. ST-28F Agricultural Exemption Certificate Rev 12-21 Author. Order for the sale to be exempt.

Fill Online Printable Fillable Blank Exemption Kansas Department of Commerce Form. This notice is available by calling 785-368-8222 or from our web site. Kansas Sales Use Tax for the Agricultural Industry at.

The application will ask for your Kansas Tax Exemption Number and a PIN. _____ Business Name. Sales and Use Tax Refund.

Save Time Signing Documents from Any Device. Select the application Add an Existing Tax Exempt Entity Certificate to this account. Sale Tax Exemption Form information registration support.

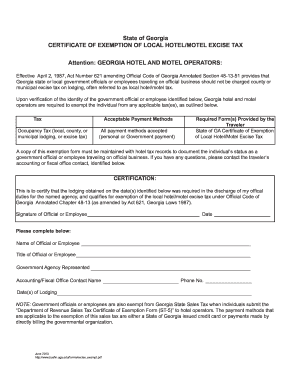

Georgia Tax Exempt Form Hotel Fill Out And Sign Printable Pdf Template Signnow

Kansas Exemption Form Fill Out And Sign Printable Pdf Template Signnow

Form St 28h Download Fillable Pdf Or Fill Online Sales And Or Transient Guest Tax Exemption Certificate For Lodging Kansas Templateroller

Form St 28d Download Fillable Pdf Or Fill Online Ingredient Or Component Part Exemption Certificate Kansas Templateroller

Sc St8f Fill Out And Sign Printable Pdf Template Signnow

Agriculture Sales Tax Exemption Florida Elegant Resale Certificate Request Letter Template Unique Letter Templates Certificate Templates Business Plan Template

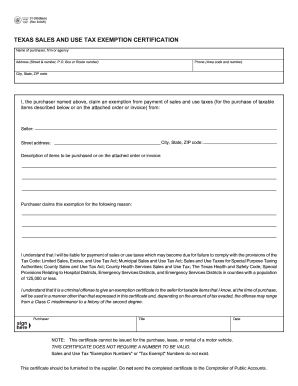

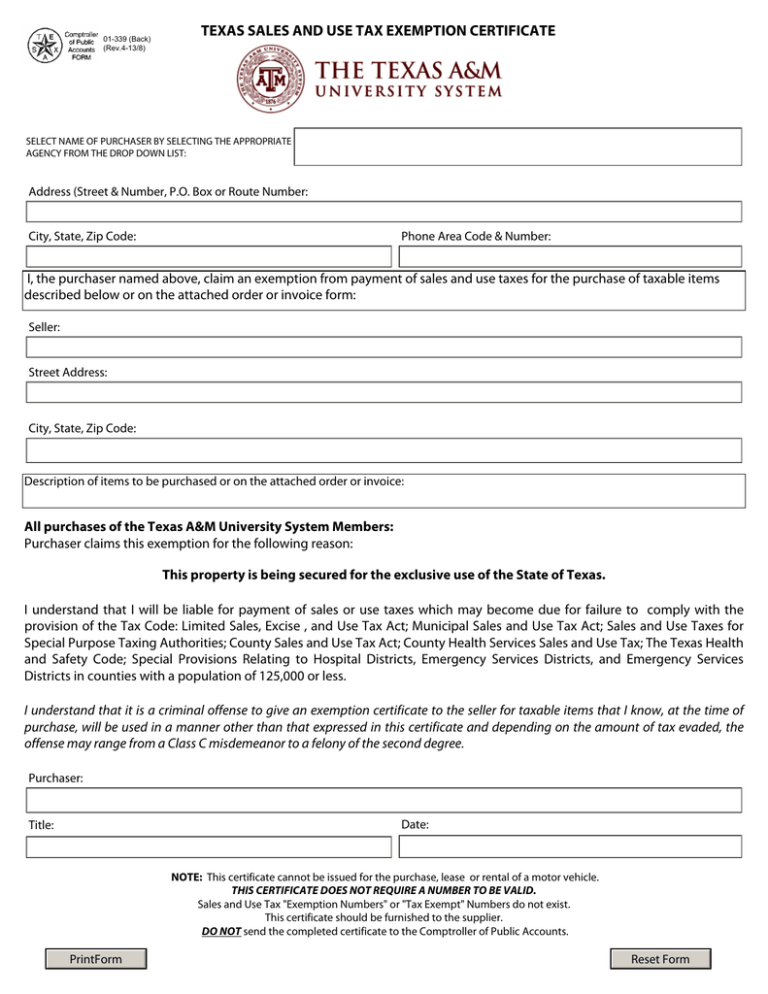

Texas Fillable Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Pa Dor Rev 1220 As 2020 2022 Fill Out Tax Template Online Us Legal Forms

Texas Sales And Use Tax Exemption Certificate

Fillable Online Kansas Sales And Use Tax Exemption Certificate Um Infopoint Fax Email Print Pdffiller

Kansas Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

What Is A Homestead Exemption Protecting The Value Of Your Home Homesteading What Is Homestead Property Tax